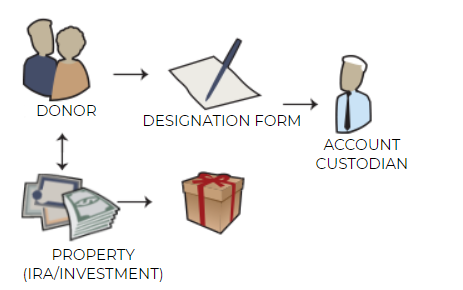

Secure the future of our mission by naming us as a beneficiary in your will, trust, or beneficiary designation form, ensuring your support continues beyond your lifetime.

Establish a charitable remainder unitrust with cash or appreciated property, providing you with tax-free income for life or a specified term, while supporting our vital work.

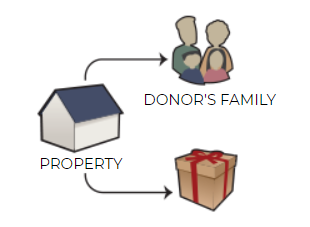

A charitable bequest is one of the easiest and most flexible ways that you can leave a gift to Sahaba WAQF that will make a lasting impact.

A bequest is one of the easiest gifts to make. With the help of an attorney, you can include language in your will or trust specifying a gift to be made to family, friends or Sahaba WAQF as part of your estate plan, or you can make a bequest using a beneficiary designation form.

If you have any questions about an IRA charitable rollover gift, please contact us. We w ould be happy to assist you and answer any questions you might have.

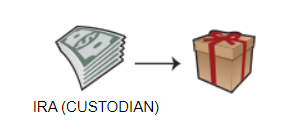

Donating part or all of your unused retirement assets, such as your IRA, 401(k), 403(b), pension, or other tax-deferred plan, is an excellent way to make a gift to Sahaba WAQF.

If you are like most people, you probably will not use all of your retirement assets during your lifetime. You can make a gift of your unused retirement assets to help further our mission.

To leave your retirement assets to Sahaba WAQF, you will need to complete a beneficiary designation form provided by your retirement plan custodian. If you designate Sahaba WAQF as beneficiary, we will benefit from the full value of your gift because your retirement assets will not be taxed at your death. Your estate will benefit from an estate tax charitable deduction for the gift.

Did you know that 40%-60% of your retirement assets may be taxed if you leave them to your heirs at your death? Another option is to leave your heirs assets that receive a step up in basis, such as real estate and stock, and give the retirement assets to Sahaba WAQF. As a charity, we are not taxed upon receiving an IRA or other retirement plan assets. You can use the “Make a Future Gift of Retirement Assets” tool to contact your retirement plan custodian and designate a future gift to Sahaba WAQF.

You may be looking for a way to receive fixed income for life or a number of years. You may be concerned about the high cost of capital gains tax with the sale of an appreciated asset. Perhaps you recently sold property and are looking for a way to save on taxes and plan for retirement. A charitable remainder annuity trust may offer the solutions you need.

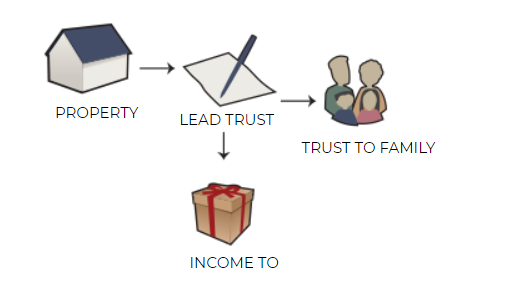

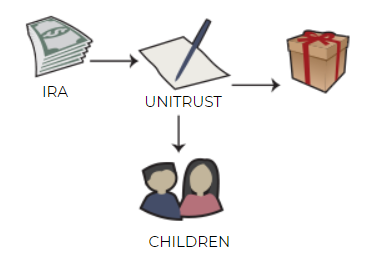

You may be looking for a way to provide your children with income while making a gift to Sahaba WAQF. The “give it twice” trust is a popular option that allows you to transfer your IRA or other asset at death to fund a term of years charitable remainder unitrust. We call this kind of unitrust a give it twice trust because you can use the trust to pay income first to your family for a number of years and then distribute the balance of the trust to charity.

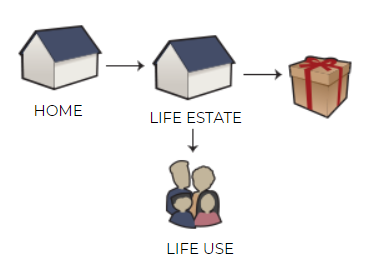

You may desire to leave your home or secondary property to Sahaba WAQF at your death but would also like to receive a current charitable income tax deduction. A life estate reserved might offer the solution you need!

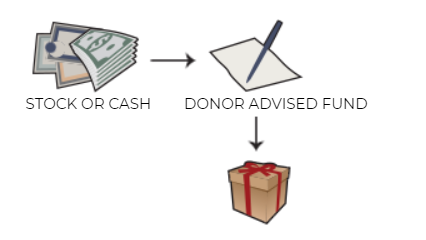

Are you looking for a way to benefit Sahaba WAQF both now and in the future? Would you like to simplify your annual and lifetime charitable giving?

A donor advised fund (or DAF) might be a great solution for you. You can also use a DAF to distribute gifts to numerous charities. With a DAF, you can make gifts to charity during your lifetime, and when you pass away, your children can carry on your legacy of giving.

A donor advised fund has several advantages when compared to a private foundation. The start-up time and cost are minimal for DAFs, and gifts to DAFs are generally deductible at fair market value. A DAF is also not subject to the distribution requirements and certain excise taxes faced by private foundations.